Peak rate in excess of 5%

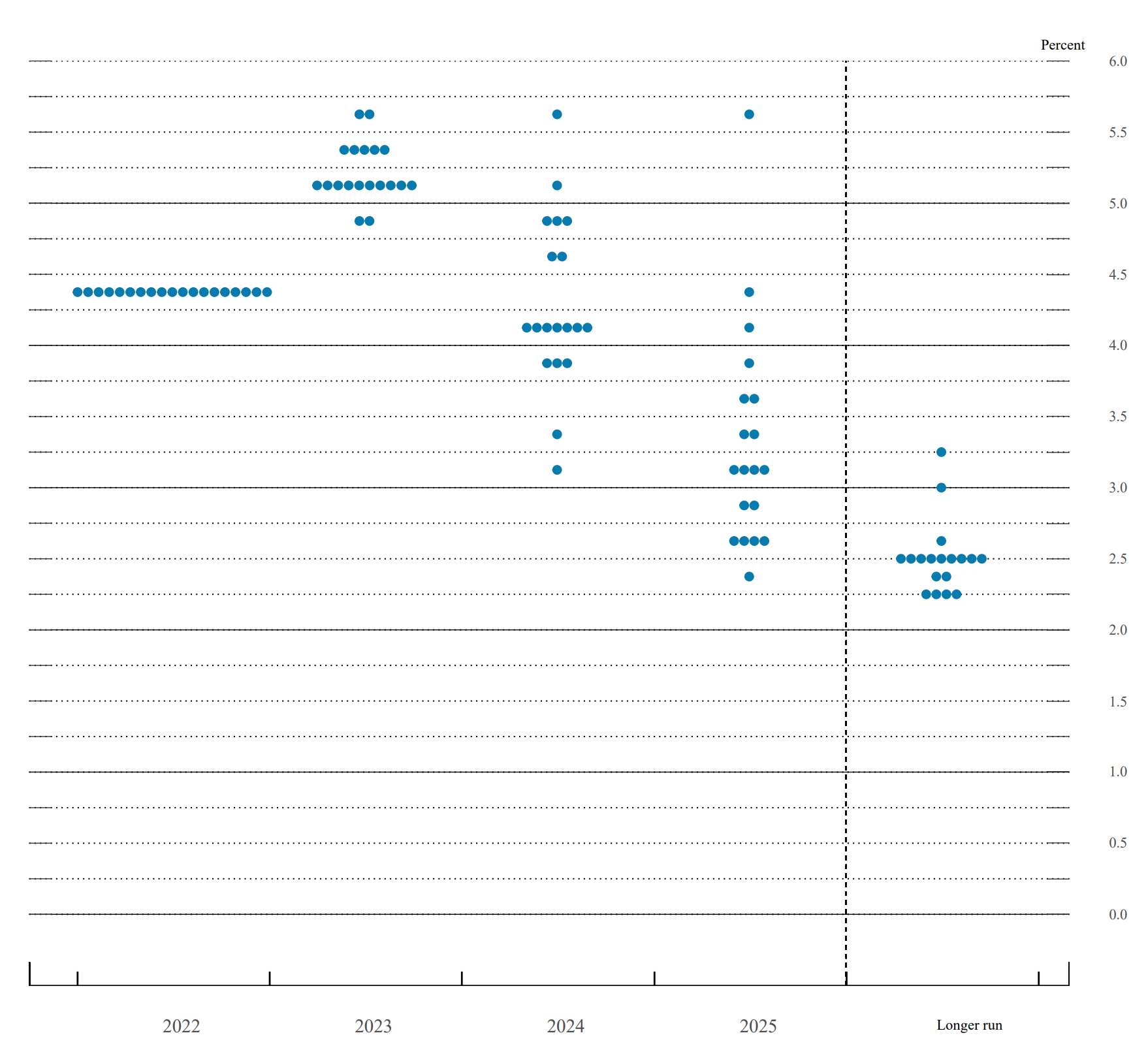

The recent meeting of the Federal Open Market Committee (FOMC) went largely as expected. The committee raised interest rates by 50 basis points. FOMC members also provided an updated Summary of Economic Projections (SEP) as shown below. The surprise may have been that FOMC raised the projection for the peak rate in 2023 by 50 basis points to 5-5.25%. Interestingly, the median inflation projections also rose despite better recent inflation news. The market is pricing in two additional rate hikes of 25 basis points each in February and in March, resulting in a peak rate of around 5%.

In terms of macro economic data, the FOMC meeting came against a backdrop of mixed signals on final demand, labor markets and inflation. The data does not yet suggest that a hard landing is imminent. The November CPI print and retail sales reports were weaker than consensus but at the same time the labor market remains resilient.

When asked about the possibility of rate cuts next year, Powell said that the FOMC will only cut rates if it is confident that inflation is moving down in a sustained manner. Clearly they need substantially more evidence that inflation is on a downward path.

If payrolls continue to run at their recent pace, combined with upside surprises in inflation data, dialing down the hawkish rhetoric is going to be challenging. There are also favorable developments with respect to China reopening.

However, recent market events, such as private credit and real estate funds gating redemptions and a wave of bankruptcies in the crypto space, suggests to us that some market stresses are starting to emerge. It may well be that the market is struggling to come to terms with the higher cost of capital.

“As you will have seen, 19 people filled out the SEP this time, and 17 of those 19 wrote down a peak rate of 5% or more. So that’s our best assessment today for what we think the peak rate will be. You will also know that at each subsequent SEP during the course of this year we actually increased our estimate of what that peak rate will be. And today the SEP shows overwhelmingly FOMC participants believe that inflation risks are to the upside so I can’t tell you confidently that we won’t move up our estimate of the peak rate again at the next SEP. I don’t know what we’ll do. It will depend on future data.”

Figure 1. FOMC participants’ assessments of appropriate monetary policy

Source: Federal Reserve

DISCLAIMER

Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. This document does not constitute investment advice. This document was issued in Finland by AIM Capital Ltd. (the “Alternative Investment Fund Manager” or the “AIFM”), an alternative investment fund manager authorized with the Finnish Financial Supervisory Authority. This document has been provided to you for information purposes only. It may not be published or distributed without the express written consent of the AIFM. This document is not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument or investment product. Any such offer or solicitation may only be made by means of delivery of an approved confidential information memorandum and the fund rules to an investor who meets the Fund’s eligibility and suitability requirements. Any investment decision should be made based solely upon the information contained in the Fund’s approved confidential information memorandum, the fund rules and subscription documents. This document may not be relied upon by you in evaluating the merits of investing in any financial instruments or investment product referred to herein. In addition, any investor who subscribes, or proposes to subscribe, for an investment in the Fund must be able to bear the risks involved in such investment. Some or all alternative investment funds may not be suitable for certain investors. No assurance can be given that stated investment objectives will be achieved. Hedge fund investments are typically speculative and involve a substantial degree of risk. The Fund may be leveraged and engage in other speculative investment practices that may increase the risk of investment loss. An investor or prospective investor must realize that he or she could lose all or a substantial amount of his or her investment. For further information regarding the risk factors and conflicts of interest in respect of an investment in the Fund, an investor or prospective investor should refer to the Fund’s approved confidential information memorandum, the fund rules and subscription documents. No representation or warranty is given with respect to the accuracy or completeness of this document, including the accuracy or sufficiency of any of the information or opinions herein. The AIFM on its own behalf and on behalf of its affiliates, partners and employees disclaims any and all liability relating to this document, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this document. The above information and figures are unaudited and may be subject to change. Past performance is not indicative of future results, and an individual investor might have experienced different results for the period in question had it withdrawn or contributed capital on an intra-year basis. Performance of the Fund may also be adjusted as disclosed in the confidential information memorandum of the Fund, for example, to account for the costs and benefits of hedging foreign currency exposure between investments in one currency and the operating currency of the Fund and allocations of the benefit of certain “new issues”. The information and analyses contained herein are not intended as tax, legal or investment advice. The distribution of this document may be restricted by law in certain jurisdictions. Persons into whose possession this document comes are required to inform themselves of, and comply with, any such restrictions. This document is not intended to be made available to any person in any jurisdiction where doing so would contravene any applicable laws or regulations.